AI Investment Lifecycle and Implications for AI Video Analytics

Graeme Woods

Global Business Analyst

Computer vision for security is now an established AI technology. Purchasers understand that this technology can bring practical benefits. What are the implications of video analytics for security moving from being novel to becoming mainstream, and how does this impact purchasers?

AI technology lifecycle

Startups in security video analytics are generally VC-funded.

VCs invest in startups that apply transformational technologies, including AI, that have the potential to provide high returns. VCs typically focus on a technology theme (for AI, this is the type of AI and the application) and then select the startup based on:

● Alignment to their technology themes ● Management team capabilities ● Product / market fit ● Business model and commercial aspects ● Product / prototype

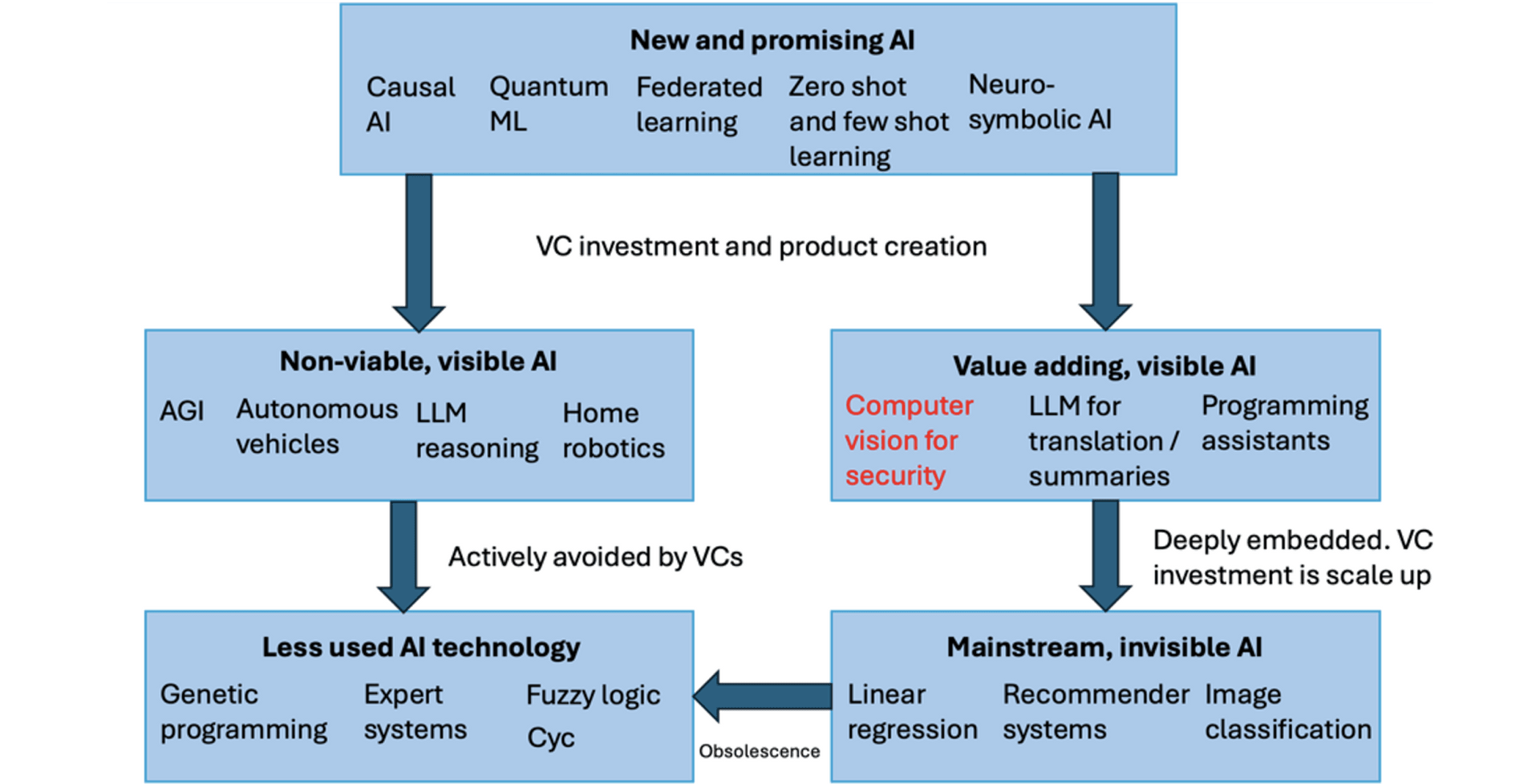

Initial VC funding helps build and launch a product. Some technologies result in products that meet market needs. Other technologies never become practical or are overtaken by newer approaches. An example of a technology that is visible but not currently practical is general-purpose home robotics.

Security video analytics as a technology has met market needs. The results of startups have varied, based on the skills and experiences of their management teams.

Startups in mature technologies are not normally funded because there aren’t the potential returns to justify the risks. For example, if you now proposed to build a product to compete with Microsoft Office, a VC would not invest in that.

Successful AI technologies eventually become invisible as they are deeply embedded and taken for granted. Some examples are spell checking, face recognition, recommender systems and predictive text. Eventually even successful AI approaches are replaced by new methods and are retired.

Some technologies never result in useful products or are overtaken by better approaches. These end up becoming of historical or niche interest only and are actively avoided by investors (unless there is a breakthrough). Examples include expert systems, fuzzy logic, logic programming and genetic programming.

This diagram shows the lifecycle of AI algorithms:

AI funding by VCs

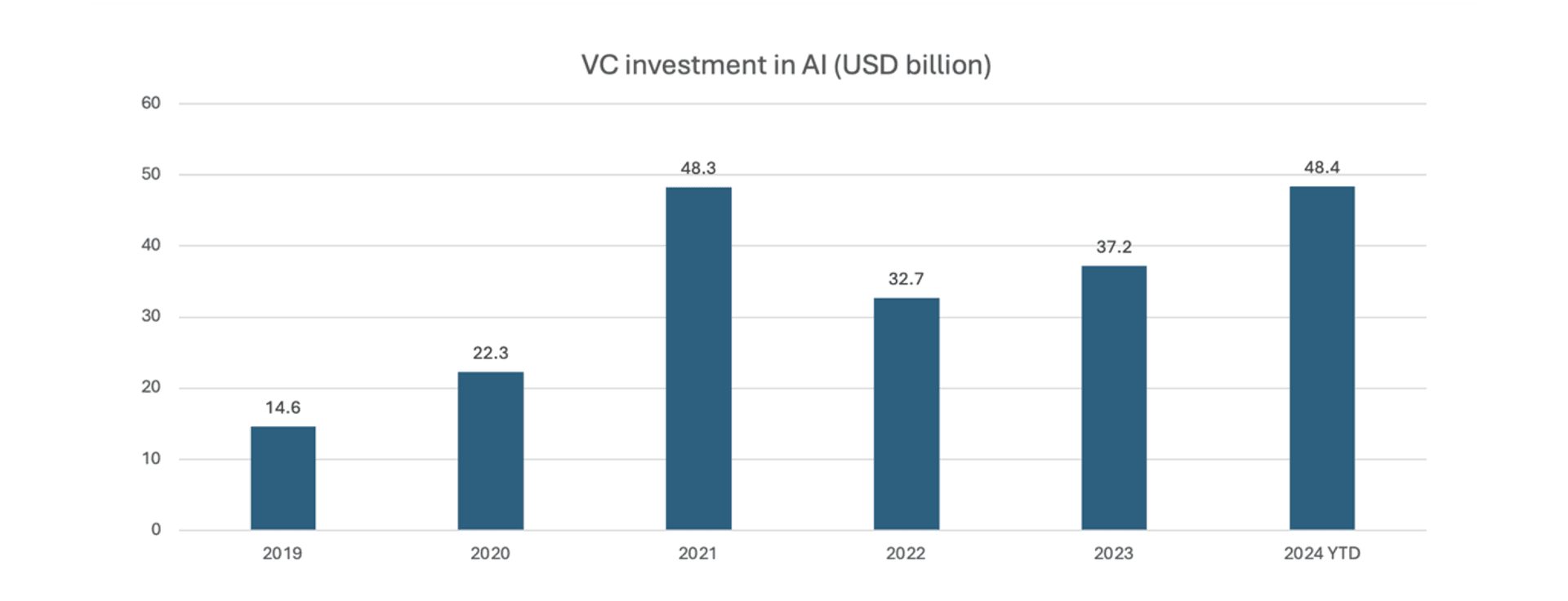

Security AI video analytics was a new technology in 2019, but now it has proven that it is practical, saving money and extending the capability of security managers. While successful incumbents such as Scylla are improving the technology, VCs are now focused on initial funding of other promising technology.

This chart shows VC investment in AI. 2021 was the peak year for computer vision startups. 2023 and 2024 funding has focused on LLMs.

VCs are not funding new security video analytics startups and are not continuing to fund companies that don’t have prospects of profitability. Some existing companies that have gained product/market fit and traction are able to raise additional funding to extend their sales and marketing.

Implications

What are the implications for purchasers of security video analytics solutions? The fact that VCs are now focused on either new technologies or scaling up already successful security companies means that unsuccessful companies that haven’t established prospects of profitability are finding it almost impossible to raise more funds. These companies have already laid off their development teams and will eventually exhaust their runway and go out of business.

Here are some implications:

1. Vendor continuity Choosing a product from a vendor that won’t be around for the lifespan of the product (5+ years) is a risky choice. You may end up with no support, and there won’t be updates, patches or support for operating system upgrades. When unsuccessful companies are acquired, users normally suffer very large license cost increases.

2. Product extension Without traction or additional funding, a company with an incomplete product won’t be able to fund additional development. It is unrealistic to buy from a “one trick pony” vendor in the hope that they can extend their solution.

3. Integrations This also applies to integrations. If a vendor doesn’t have integrations now and is not a mainstream, established vendor, they may find it difficult to fund costly integration development work. Security managers may miss out on vital integrations that are needed to benefit from existing infrastructure.

4. Ongoing upgrades A company without adequate funding won’t be able to continue to update the product as approaches advance over time. These advances are not typically new technologies like the original work underpinning computer vision for physical security applications, or LLMs, but are incremental changes that improve performance, usability and provide new options.

For security managers, being stuck with out-of-date software means that your site may have lower productivity than sites with newer software.

Conclusion

As a security manager, it pays to be aware of these facts when selecting a solution:

● Computer vision for physical security is now a mainstream technology. ● VCs fund either new technology or companies that are already successful. ● VCs are not funding new startups in this area or giving more money to startups that have failed. ● The wisest approach is to work with vendors that have complete products, that have an active development program and that are already financially viable.

Stay up to date with all of new stories

Scylla Technologies Inc needs the contact information you provide to us to contact you about our products and services. You may unsubscribe from these communications at any time. For information on how to unsubscribe, as well as our privacy practices and commitment to protecting your privacy, please review our Privacy Policy.

Related materials

Securing Our Schools: Scylla and Konica Minolta Join Forces for Visual Weapon Detection

Discover how schools, hospitals, and other organizations improve video surveillance with the cutting-edge visual weapon detection solution from Konica Minolta and Scylla.

Read more

How Technologies Help Mitigate Gun Violence

With gun violence on the rise security experts and first responders need technological tools that can help prevent and respond to it. Learn what gun detection technologies are currently used and what advantages and weaknesses they have.

Read more

Addressing US Active Shootings with Scylla AI Gun Detection

Learn how AI-powered video analytics can help enhance the safety and security of our communities in the face of the ongoing active shooting threat.

Read more